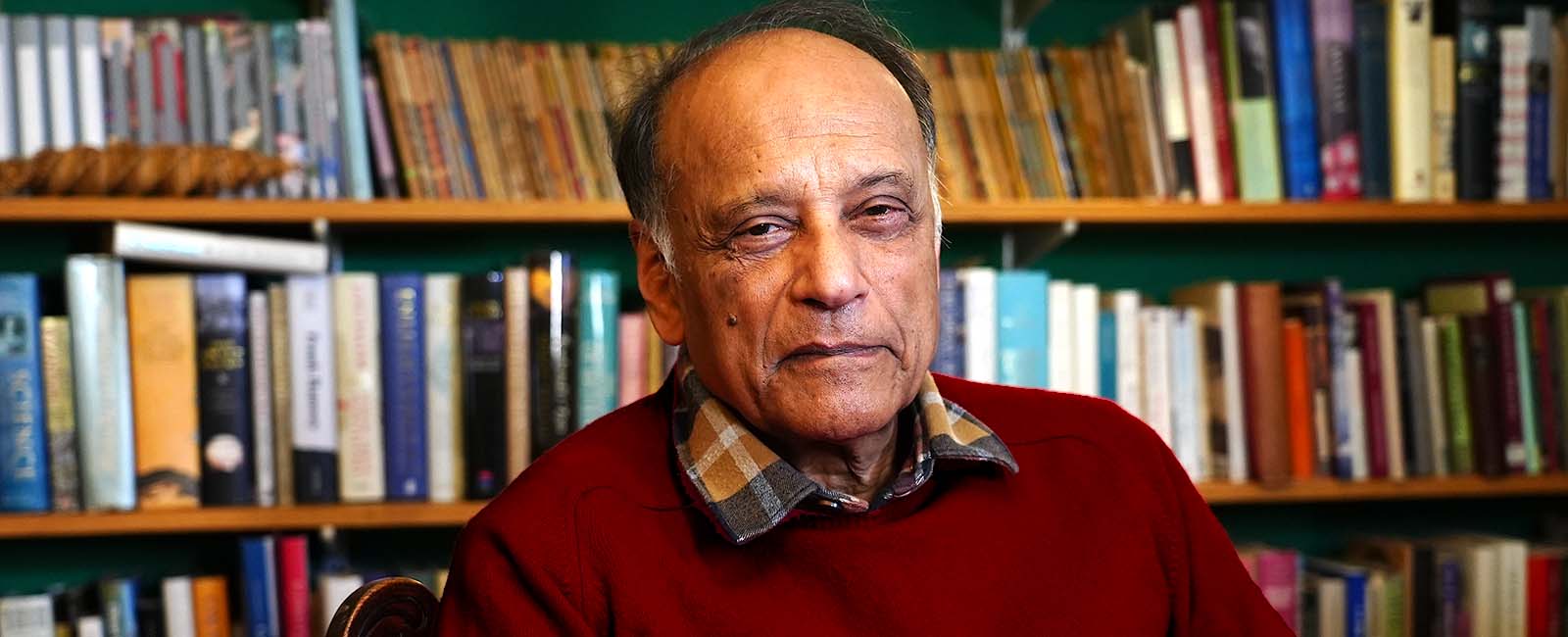

The Frontiers of Knowledge Award goes to Partha Dasgupta for defining the field of environmental economics by incorporating and quantifying the social value of nature

The BBVA Foundation Frontiers of Knowledge Awards in Economics, Finance and Management has gone in this sixteenth edition to Partha Dasgupta (University of Cambridge) for laying the foundations of environmental economics, through his pioneering work “on the interaction between economic life and the natural environment, including biodiversity,” said the committee in its citation. His research, dating back to the 1970s, has provided “a basis for analyzing how societies with a fixed quantity of depletable resources should allocate resources over time and invest in alternative technologies,” to facilitate their conservation.

28 February, 2024

Dasgupta provided conceptual foundations “for the definition and measurement of sustainable development,” with “the social value of nature” as a determining factor. “In contrast with measures of well-being based on flows such as GDP,” the citation continues, “Dasgupta proposed measuring sustainable development as the change in the accounting value of total wealth,” including natural capital within this indicator. “These ideas,” it concludes, “have provided a framework for green accounting which is now widely adopted for measuring sustainable development.”

For committee member Lucrezia Reichlin, Professor of Economics at the London Business School, Dasgupta’s approach rests on two lines of argument: firstly, “that the important measure for sustainability has to be based on wealth and the change of wealth over time, and not at a given moment as happens with flow measures like GDP,” and secondly, “that this wealth must be measured not by market prices, because nature is undervalued due to externalities, but by the social value of nature.”

Dasgupta’s work and his proposals for measuring economic well-being “are critical for our time,” remarked Nobel Economics laureate Eric Maskin, chair of the selection committee. “More than any other economist of our time, he has stressed the important interplay between economic life and the natural environment. In all his work, he emphasizes that all economic activity has implications for our natural environment, often negative implications unfortunately (degradation of the environment), and that those implications must be taken account of in order to formulate and carry out economic policy that really makes sense, not just for the people in our world today, but for future generations.”

From resource economics to process economics

In his early research in the 1970s, Partha Dasgupta posed himself the question: Is it possible to substitute exhaustible, limited resources with other assets? In seeking an answer with co-author Geoffrey Heal in their 1974 paper “The Optimal Depletion of Exhaustible Resources,” published in the Review of Economic Studies, they reached the conclusion that such substitution was not feasible and that an economy must conserve and distribute its natural resources over time, since the capital generated by the exploitation of natural assets could not substitute the depleted stocks – not in accounting terms and far less in material terms (corporate profits cannot, for example, replace the trees felled in the process of manufacturing paper).

“Most economists who work on natural resources or the environment think about nature as providing certain types of goods, like food, clean water, timber, fibers or pharmaceuticals,” said Dasgupta in an interview minutes after hearing of the award. “So these are goods. These are objects that you can harvest from nature and transform with our human ingenuity into a final product, like the clothes we are wearing or the painting in the room where you are sitting, and so forth. These are the things we make out of the goods that nature gives us.”

At the core of this conventional line of economic thought, he explains, is that when a good becomes scarce, you can substitute it with another offering the same or similar results. But as he delved deeper into the subject, Dasgupta came to realize that nature supplies something much more important and irreplaceable than goods. It supplies processes (or in more economic terms, services). “My own understanding of economics,” he says, “has moved away from goods to processes. These are the key things we economists should keep in mind. Of course we care about nature’s goods, like water, food and clothing, because without them we wouldn’t be here. But none of this would exist without the underlying processes of nature.”

Climate regulation is among the services, or processes, that Dasgupta uses to illustrate his point: sunlight comes and gets reflected into space, water evaporates and comes down as rain. “You have the water cycle and you get your drinking water from it. And what is not consumed doesn’t disappear, it just evaporates or becomes part of the ocean through the river system and so forth. But if you mess around too much with climate, you also mess around with the water cycle, which will end up weakened. Likewise, if you deforest too much or get rid of biodiversity in the Amazon, you’re going to exacerbate the climate system. So my work has been to bring these issues into economics.”

Dasgupta believes economics has become overreliant on the idea that scarcity can be overcome by substituting goods: “In industrial production, of course, this idea of substitutability has been a great success. Think of all the materials that are produced in engineering departments or material science departments. But there are limits to this, when you tamper with processes. Just think of the human body. You have the metabolic process, which keeps you in a healthy state, and it would be foolish to think you could substitute one process for another. You wouldn’t say let me have less digestive capacity, but more running capacity. It would be silly, because these two things go together.” The problem we now face is that some of nature’s processes are threatened by the climate change and biodiversity losses being driven by human activity.

A more precise measurement of wealth

The ideas Dasgupta has developed in over forty years of research has implications for pricing systems, economic and regulatory policies and, an aspect he believes merits special attention, the measurement of wealth and well-being. He maintains that conventional indicators like GDP cannot give the real value of an economy; firstly, because they are flow measures, reflecting the goods or services produced in that economy over a set period of time (conventionally a year in the case of GDP): “The trouble with flow is that it doesn’t tell you anything about what might happen tomorrow,” Dasgupta points out. “For that, you need stocks.”

His proposal, accordingly, is to measure wealth and well-being by reference to changes in the stock of capital over time across all goods and services: “In the same way that companies have balance sheets, as well as profit and loss accounts, we should have balance sheets that include natural capital, not just factories, educated people, machines and so forth, which are already there in the national statistics, but nature as well.”

The second reason he gives for rejecting GDP as a valid measure is that it does not reflect capital depreciation (the gross in gross domestic product means depreciation is not subtracted). The result is that the case could arise (and is likely happening right now) where a country reporting high rates of GDP growth is actually eating into nature. “And that’s very dangerous because you can suddenly find yourself in difficulty, as we are now with climate change. Climate change is a problem, but GDP doesn’t reflect it, because carbon concentration is not part of its calculation. So when measuring wealth, you have to include nature as part of that wealth, that is, the ecosystems you are using for your purposes. Sustainable development should ideally mean that this inclusive notion of wealth increases over time, and does not decline. That’s sustainable development.”

Dasgupta points out that countries like the United Kingdom are looking at ways to draw up this kind of wealth account. And the United Nations Statistical Office has been trying for some time to estimate stocks, as has China. “The figures are going to be crude,” he warns, “because this has not been tested yet. And they’re going to be taking time. But because the theory is solid, nobody’s questioning its desirability. It’s a question of getting it right rather than whether we should do it. You have to do it, no question about it. You have to keep track of stocks as you move along in an economy.”

In this respect, the socioeconomic research program run jointly by the BBVA Foundation and the Valencian Institute for Economic Research (Ivie) has recently prepared natural capital estimates for Spain, using the UN methodology, which draws, in turn, on Dasgupta’s work. For Ivie’s Research Director, Francisco Pérez, the awardee’s call for more suitable metrics to assess how national economies and the world economy are performing has never been more pertinent. “The natural capital estimates drawn up for Spain suggest that the GDP and population growth of recent decades has outrun per capita stocks of natural capital. Paying heed to this type of evidence when assessing development is an example of what Professor Dasgupta is saying: we need adequate measures to be able to interpret reality correctly, to know whether we are moving forward or backward and enact the right policies.”

The economy, a phenomenon of nature

This close relationship between the economic and natural worlds is a constant in Dasgupta’s research; more indirectly in his early studies but very much center stage in the last decade: “My main contribution, I think, lies in recognizing that the human economy is not separate from nature. It is part of nature, it is embedded in nature. And the distinction between being external to nature and being embedded in nature is absolutely fundamental.” It is in the light of this idea that he has rewritten and reconstructed the macroeconomics of development and economics of poverty.

“What I am proudest of,” he says, “is having been able to reconcile economics and ecology. I believe the two subjects are tightly interconnected. My intuition was that ecology was important, but I had to learn more about it.” Part of this learning process was his time as chairman of the Scientific Advisory Board of the Beijer Institute of Ecological Economics in Stockholm, where he came into contact with some of the world’s top ecologists, “including several who have won the Frontiers of Knowledge Award in their specialty: Edward Wilson, Paul Ehrlich, Simon Levin, Tom Lovejoy, Jane Lubchenco… They have become close friends of mine, and I learned at their feet. I am still learning. And of course, I have to say I teach them economics as well. We have had a running dialogue for 30 years now.”

Economics and ecology share the same etymological root: oikos or “home” in classical Greek. Dasgupta reflects on this origin: “Home or household doesn’t have to be just your family home, it can be your city, community or nation, collectives whose different parts have a complicated relationship, just as populations of a species, a kind of bird for example, can cooperate or fight like we humans do. So I realized that there’s a lot we economists can learn from ecologists by looking at these complex systems.”

This cross-disciplinary reach extends further even than the close relation between economics and ecology. For three years, Dasgupta led the Ethics in Society program at Stanford University, and in his long career has dialogued not just with ecologists and biologists but with practitioners of other disciplines, including philosophy.

The Dasgupta Review on “the economics of biodiversity”

It is not only in research that Dasgupta has left his mark, as Lucrecia Reichlin points out. “As well as a theorist who laid the foundations of environmental economics, he is also an advocate for the natural world. And these two facets came together in his leadership of the Dasgupta Review, as it is known, where he brought both his theory work and work on measurement to bear on the issue of biodiversity. The review was commissioned by the UK Treasury and, since it came out in 2021, has had a big impact on the discussion of how we should think about growth in relationship to the environment.”

Dasgupta refers to the review when asked what measures we can take to put his theoretical insights into practice, for it offers abundant examples from the micro level, in the hands of local or national authorities, up to initiatives on the global stage. In this last sphere, he proposes the setup of a new supranational institution.

The problem, he concludes from his conversations with leading political figures, is that the world is not ready for an international organization to take on this role. “To which my answer used to be, and still is, that at the end of the Second World War, Europe was completely on its knees, the Far East too, and the world economy was shattered. But within three years we created the United Nations, the World Bank and the IMF. All these international organizations were created in a period of between five and ten years. Why did we do that? Because we needed these public goods. We needed peace, which is a public good. We needed development, which is a public good. We needed financial stability, which is a public good. Now here is a situation where we are running into difficulties with another public good, nature. The problem is not the logic of the proposal, it’s the politics or the feasibility perhaps.”

Nominator

A total of 59 nominations were received in this edition. The awardee researcher was nominated by Leonardo Felli, Chair of the Faculty of Economics at the University of Cambridge (United Kingdom).

Economics, Finance and Management committee and evaluation support panel

The committee in this category was chaired by Eric S. Maskin, Adams University Professor at Harvard University (United States) and Nobel Laureate in Economics, with Manuel Arellano, Professor of Economics in the Center for Monetary and Financial Studies (CEMFI) of Banco de España acting as secretary. Remaining members were Antonio Ciccone, Professor of Economics at the University of Mannheim (Germany); Pinelopi Koujianou Goldberg, Elihu Professor of Economics and Global Affairs at Yale University (United States); Andreu Mas-Colell, Professor Emeritus of Economics at Pompeu Fabra University and the Barcelona School of Economics (Spain); Lucrezia Reichlin, Professor of Economics at the London Business School (United Kingdom); and Fabrizio Zilibotti, Tuntex Professor of International and Development Economics at Yale University (United States).

The evaluation support panel charged with nominee pre-assessment was coordinated by Hugo Rodríguez Mendizabal, Tenured Scientist at the Institute for Economic Analysis (IAE, CSIC) and formed by: Laura Mayoral Santamaría, Scientific Researcher at the Institute for Economic Analysis (IAE, CSIC); Socorro Puy Segura, Professor in the School of Economic and Business Sciences at the University of Málaga; Xavier Ramos Morilla, Professor in the Department of Applied Economics at the Universitat Autònoma de Barcelona; and Virginia Sánchez Marcos, Professor of Fundamentals of Economic Analysis in the Department of Economics of the University of Cantabria.

About the BBVA Foundation Frontiers of Knowledge Awards

The BBVA Foundation centers its activity on the promotion of world-class scientific research and cultural creation, and the recognition of talent.

The BBVA Foundation Frontiers of Knowledge Awards, funded with 400,000 euros in each of their eight categories, recognize and reward contributions of singular impact in physics and chemistry, mathematics, biology and biomedicine, technology, environmental sciences (climate change, ecology and conservation biology), economics, social sciences, the humanities and music, privileging those that significantly enlarge the stock of knowledge in a discipline, open up new fields, or build bridges between disciplinary areas. The goal of the awards, established in 2008, is to celebrate and promote the value of knowledge as a public good without frontiers, the best instrument to take on the great global challenges of our time and expand the worldviews of individuals for the benefit of all humanity. Their eight categories address the knowledge map of the 21st century.

The BBVA Foundation has been aided in the evaluation of nominees for the Frontiers Award in Economics, Finance and Management by the Spanish National Research Council (CSIC), the country’s premier public research organization. CSIC has a preferential role in the appointment of members to the evaluation support panels made up of leading experts in the corresponding knowledge area, who are charged with undertaking an initial assessment of the candidates proposed by numerous institutions across the world, and drawing up a reasoned shortlist for the consideration of the award committees. CSIC is also responsible for designating each committee’s chair and participates in the selection of remaining members, thus helping to ensure objectivity in the recognition of scientific excellence.