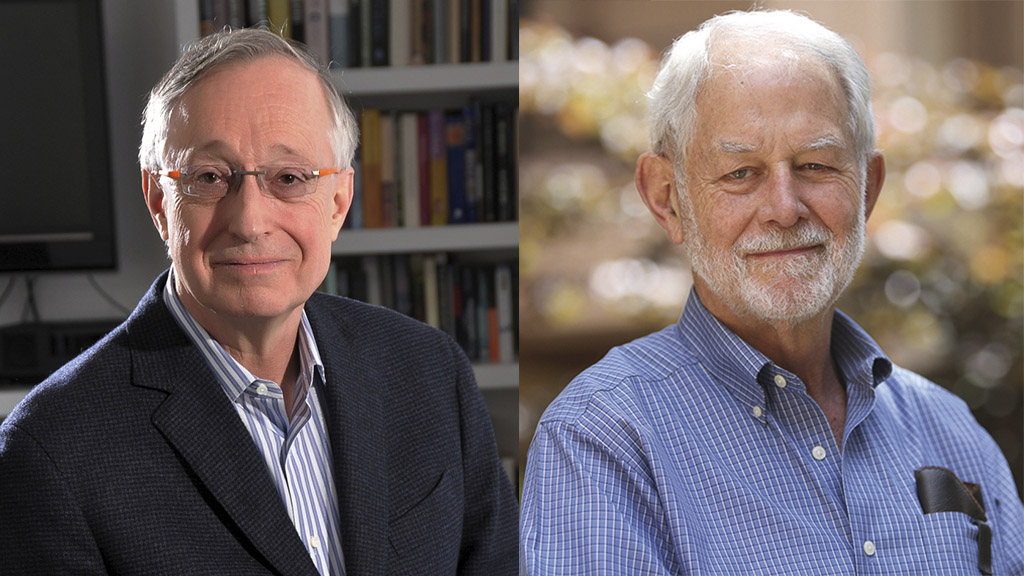

The Nobel Prize in Economics goes to Paul Milgrom and Robert Wilson, Frontiers of Knowledge Laureates in 2013 and 2016

The 2020 Nobel Prize in Economics has been awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.” Both economists were previously awarded the Frontiers of Knowledge Award in Economics, Finance, and Management, Milgrom in 2013 and Wilson in 2016.

12 October, 2020

In its fifth edition, the Frontiers of Knowledge Award went to Milgrom (Detroit, Michigan, USA, 1948), Professor of Economics at Stanford University, “for his seminal contributions to an unusually wide range of fields of economics including auctions, market design, contracts and incentives, industrial economics, economics of organizations, finance, and game theory,” in the words of the prize committee. “His work on auction theory is probably his best known,” the citation continued, referring to the contribution for which he has now received the Nobel Prize. “He has explored issues of design, bidding and outcomes for auctions with different rules. He designed auctions for multiple complementary items, with an eye towards practical applications such as frequency spectrum auctions.”

Three years later, in its eight edition, the BBVA Foundation’s award went to Wilson (Geneva, Nebraska, USA, 1937), also an Economics professor at Stanford, for “pioneering contributions to the analysis of strategic interactions when economic agents have limited and different information about their environment”. In the view of the jury, “his research on auctions, electricity pricing, reputation and dynamic interactions under such informational circumstances was groundbreaking and pervades economic analysis to this day”.

Milgrom made the leap from games theory to the realities of the market in the mid-1990s, while Wilson put his game theory insights to work in improving market and auction design for sectors like energy, oil and telecommunications.

Influence on the power market

It is in the power market where their influence has been most marked, and many features of today’s deregulated markets – generation tenders, nonlinear tariffs, etc. – trace their origins to the two men’s work. Not only that, their contributions to auction theory and market design have enabled many governments to improve the efficiency of procurement procedures and strategic sectors, to the benefit of all members of society.

In the mid-1990s, California telecom company Pacific Bell was preparing to bid in an auction called by the U.S. Federal Communications Commission. Wilson and Milgrom pointed out errors in the auction design that produced a worse outcome for both organizers and bidders and proposed an alternative method which the FCC agreed to try.

Their innovation, known as the simultaneous multiple round auction (SMR), replaced the traditional sealed envelope with an open bidding format, in which each company could observe what the rest were offering, supplemented by rules to prevent monopoly pricing. The auction – of electromagnetic spectrum for what was then the new generation of cell phones and other wireless communication devices – raised the record sum of over seven billion dollars, and testified in the most practical way possible to the value of game theory in strategic decision-making.